charitable gift annuity tax reporting

Jones also desires to make a gift to her favorite charity. Use e-Signature Secure Your Files.

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years.

. Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time. You paid 100000 for the annuity. Earn Lifetime Income Tax Savings.

How Taxes Deductions on Charitable Gift Annuities Work. That makes sense when you consider only part of the gift annuity is a gift to. Ad Get this must-read guide if you are considering investing in annuities.

Enter the total amount of your contribution on line 12b. January 28 2020 659 AM. Charitable Gift Annuity.

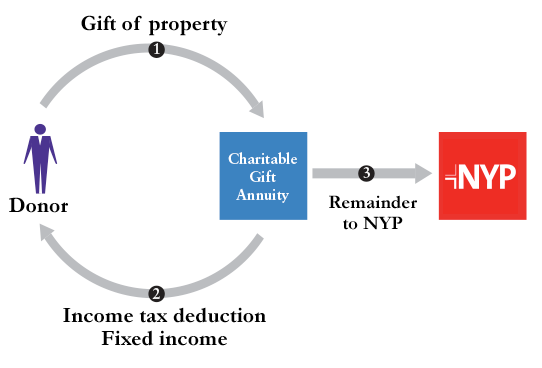

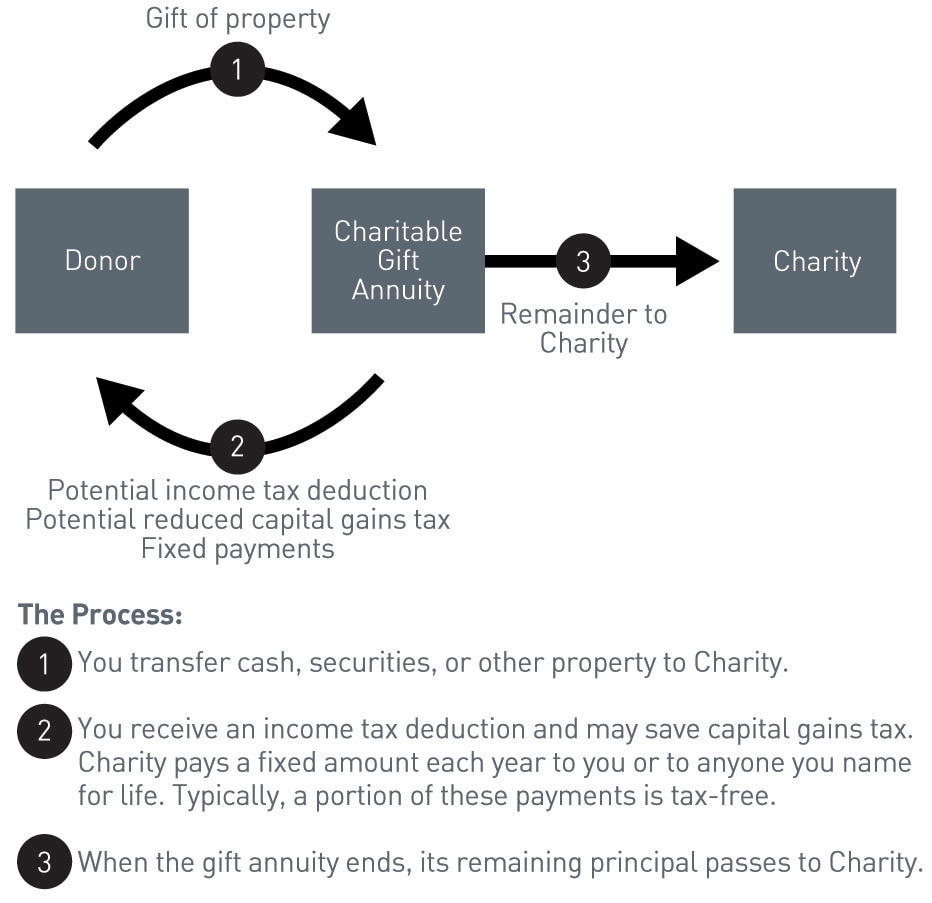

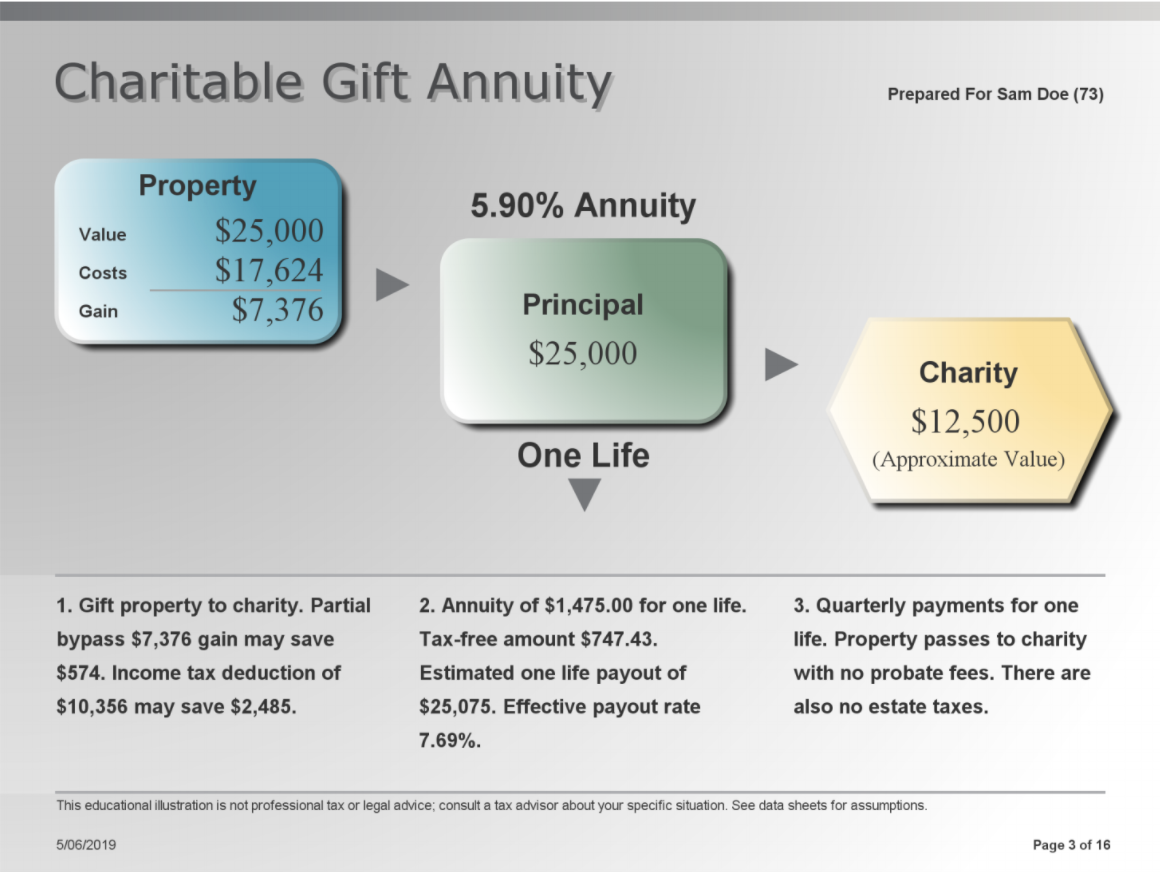

Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Learn some startling facts.

Charities must use the gift for a specific initiative if the donor specified one. Its then deductible resulting in a wash. At age 65 the rate is 47 and at age 70 it goes up to 51.

Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. It will pay her 800000 a year or 40 a year for the rest of her life. The non-charitable interest in the 50000 gift principal is equal to the investment in contract 3347450.

A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to a charity and the charity gives back an agreed-upon income stream to the donor for the. Annuities are often complex retirement investment products. Up to 25 cash back For 2013 the ACGA suggests that a 55-year-old be guaranteed a 4 annual return.

As with any other. You deduct charitable donations in the. The charitys gift is a present interest gift and is reportable if it exceeds the 13000 annual exclusion.

The charitable interest equals. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study. Give And Gain With CMC.

She has 2000000 to invest in the annuity. Presumably all means outright charitable gifts to any charity during the year totaling more than 13000. A gift annuity is deducted as a charitable donation a component of itemized deductions.

The taxation breakdown is as follows. A charitable gift annuity is a contract between a donor and a charity with the following terms. A charitable gift annuity CGA is a contract under which a 501c3 qualified public charity in return for an irrevocable transfer of cash or.

Upload Modify or Create Forms. EYs Flexible Package of Services Help Provide Confidence Against Global Challenges. The payments can begin immediately or can be.

Gift tax reporting is required for gifts to charities of remainder. Ad Integrated End-to-End Customer Tax Operation Services Supported by Global EY Teams. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study.

If you and your. Ad Download Or Email OPM Forms More Fillable Forms Register and Subscribe Now. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated.

Try it for Free Now. This calculation is usually done by the charitable. You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid.

A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. Dont enter more than. 282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the.

Ad Integrated End-to-End Customer Tax Operation Services Supported by Global EY Teams. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. A charitable gift annuity is a way you can make a gift to your favorite charity and receive fixed payments for life in return.

The deduction is calculated by taking the full gift amount and subtracting the present value of all the annuity payments. Download a PDF of this article. EYs Flexible Package of Services Help Provide Confidence Against Global Challenges.

For the 2021 tax year cash contributions up to 600 can be claimed on Form 1040 or 1040-SR line 12b. As a donor you make a sizable gift to charity using cash securities or possibly other assets.

Charitible Gift Annuities Pwna Planned Giving Partnership With Native Americans

Charitable Gift Annuities Catholic Foundation Of Ohio

Planned Giving 101 Charitable Gift Annuities Agfinancial

Salt Of The Earth Gift Annuity Guide Catholic Charities Of Northeast Kansas

Charitable Gift Annuity Licensing Compliance In Indiana Harbor Compliance

Charitable Gift Annuity Giving To St Lawrence

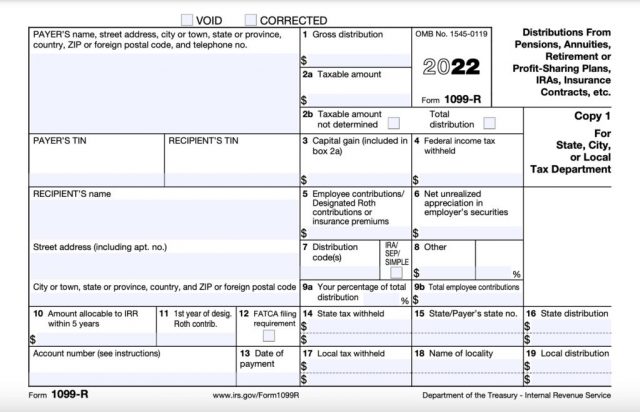

What Is A 1099 R Tax Forms For Annuities Pensions

What Is A Charitable Gift Annuity And How Does It Work 2022

Taxation Of Charitable Gift Annuities

Charitable Gift Annuities Development Alumni Relations

Everything You Need To Know About A Charitable Gift Annuity Due

Charitable Gift Annuity St Paul The Apostle Catholic Church Chino Hills Ca

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Nine Pbs Gift Annuity The Gift That Gives Back

Gifts That Provide Income Maine Organic Farmers And Gardeners